Unlock The Power Of Payroll Management

Are you ready to establish a solid understanding of payroll fundamentals?

Whether you're just starting in the field or looking to strengthen your knowledge, our Payroll Foundations Course is designed to provide you with the essential skills and knowledge you need to excel in payroll management.

GET INSTANT ACCESS NOW!

Why Choose Our Course?

Comprehensive Curriculum

Our course covers everything from the basics of payroll processes to legal compliance, payroll and tax calculations on withholdings. You'll gain a holistic understanding of payroll management.

Expert Instructors

Learn from experienced professionals in the payroll industry who are passionate about sharing their knowledge and helping you succeed.

Flexible Schedule

Our online platform allows you to learn at your own pace. Whether you're a busy professional or a full-time student, you can access the course material whenever it suits you.

Course Highlights

Introduction to Payroll Management

1. Understand the role and importance of payroll in organizations.

2. Explore the key components of payroll processing.

Calulating Payroll

1. Master your understanding of wages, deductions, and bonuses.

2. Explore overtime calculations and special scenarios.

Who Should Enroll?

1. Aspiring Payroll Professionals

2. HR Personnel and Administrators

3. Small Business Owners

4. Accounting and Finance Students

5. Anyone Seeking a Career in Payroll

Legal and Compliance

1. Navigate through complex payroll regulations and stay compliant.

2. Learn about tax obligations, labor laws, and reporting requirements.

Record Keeping and Reporting

1. Learn best practices for maintaining accurate payroll records.

2. Reports for management and auditing purposes

Enroll Today and Build a Strong Payroll Foundation

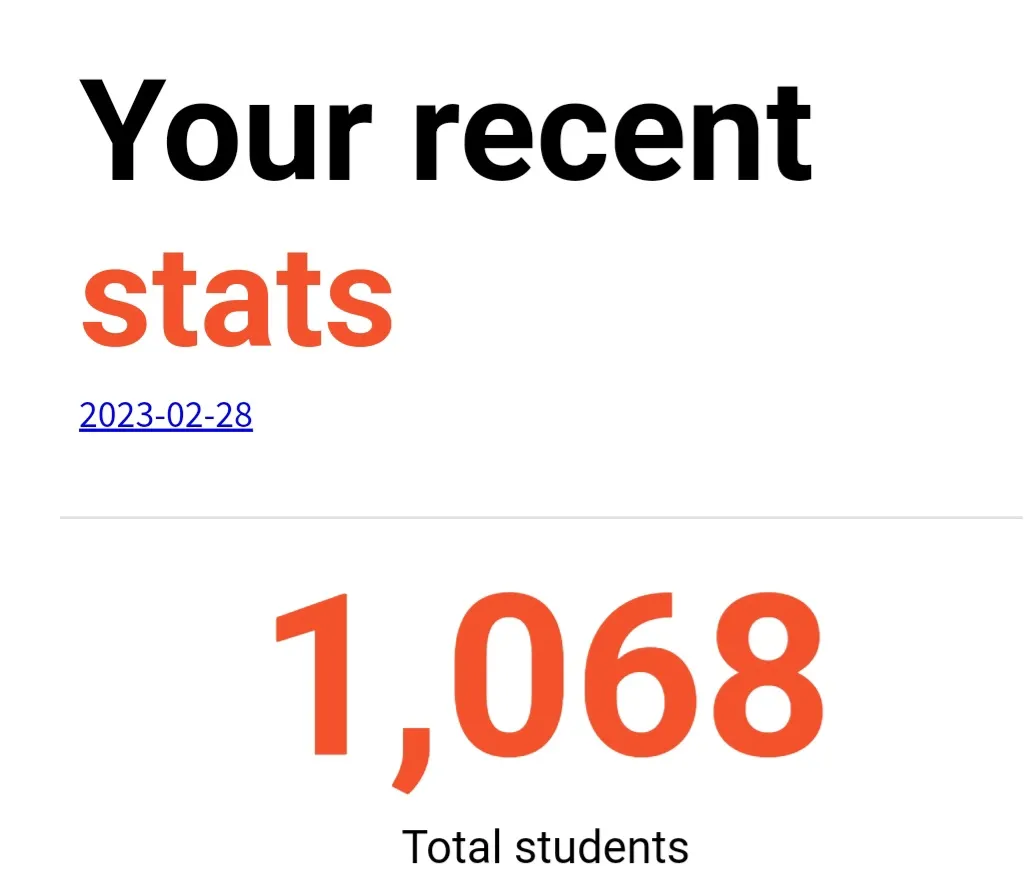

Over 1,000 students taught!

Monica Michelle K. Rating: 5.0 out

of 5 loved the course very beginner friendly and easy to understand

Shundra D.Rating: 5.0 out of 5

She was totally awesome!!

BRENT F.Rating: 5.0 out of 5

Very informative and easy tofollow.

Prishita K.Rating: 5.0 out of 5

Amazing course

Rebecca M.Rating: 5.0 out of 5

This course is perfect for me.

I love that the instructor does't race through the material and emphasizes

the very important information.

You can change your life too!

Price: $497

Fall Promo For $297

$200 Discount for a limited time only

PROMO CODE IS: payrolllaunchpad3456

Ignorance Isn't Bliss: The Consequences of Ignoring Payroll Laws

Picture this: Your business is flourishing, employees are dedicated, and the future looks bright. But in the fast-paced world of payroll management, ignorance or oversight can lead to dire consequences. Failing to adhere to payroll laws isn't just risky–it's a potential minefield of legal and financial setbacks that can shake the very foundation of your success

Examples of past penalties assessed on companies not complying with payroll laws

Walmart Inc. (2008)

Walmart settled a class-action lawsuit for $640 million regarding allegations of wage and hour violations. The lawsuit claimed that the company had failed to provide proper meal and rest breaks, resulting in underpaid wages for hundreds of thousands of employees.

Wells Fargo (2016)

Wells Fargo faced a penalty of $185 million for creating unauthorized customer accounts to meet sales targets. This case also involved employees being pressured to meet unrealistic sales quotas, leading to unethical practices.

Uber (2016)

Uber agreed to pay $100 million to settle a class-action lawsuit brought by drivers. The lawsuit argued that Uber had misclassified its drivers as independent contractors rather than employees, depriving them of benefits and protections.

Chipotle Mexican Grill (2016)

Chipotle was required to pay $1.3 million in back wages and damages to thousands of workers due to violations of the Fair Labor Standards Act (FLSA). The violations included not properly compensating employees for overtime work.

And many more!

Hi! I’m Mary!

A bookkeeping professional with 20 years of experience and a passion for empowering others to succeed. After struggling to balance a demanding job and motherhood, I decided to start my own bookkeeping business, earning $60,000 a year working just a few hours a week. This allowed me the freedom to raise my kids, attend their activities, and live life on my terms.

Now, I’m dedicated to helping others build flexible, rewarding bookkeeping careers that fit their lives, whether part-time or full-time. Through Turnkey Bookkeeping, I’ll teach you not just data entry, but real bookkeeping skills to create consistent income and freedom for your family—just like I did for mine!

Frequently Asked Questions

Who is this course designed for?

Our Payroll Foundations Course is designed for a wide range of individuals, including aspiring payroll professionals, HR personnel, small business owners, accounting and finance students, and anyone looking to establish a strong understanding of payroll management

Do I need any prior experience in payroll or finance?

No prior experience is required. This course starts from the basicsto give you a solid foundation to build off of. Whether you're new to payroll or looking to enhance your existing knowledge, you'll find value in this course

Is this course available online?

Yes, this course is entirely online. You can access the course material and modules through our user-friendly online learning platform. This offers you the flexibility to learn at your own pace and from the comfort of your preferred environment.

How long is the course?

The course duration can vary based on your learning pace. You can go as quick or as slow as you like.

Are there any assignments or assessments?

Yes, the course includes interactive quizzes and real-world case studies to reinforce your learning. These assessments are designed to help you apply your knowledge and gain practical experience in payroll management.

Will I learn about payroll software in this course?

No, this course primarily focuses on building a strong foundation in payroll management. While we won't cover specific payroll software, you'll gain a comprehensive understanding of the fundamental principles, processes, and calculations that are essential for effective payroll management. This knowledge will provide you with a solid base to work with various payroll software tools in the future

Is there a money back guarantee?

Yes! We are confident that our Payroll Foundations Course will provide you with valuable insights and knowledge that you can apply to your career. To demonstrate our commitment to your satisfaction, we offer a straightforward money back guarantee.

Our Guarantee to You

If you enroll in the Payroll Foundations Course and find that it doesn't meet your expectations within the first 7 days, we will gladly refund your full payment minus the credit card fees (we don't get to keep that either). We want you to feel confident in your decision to learn with us and believe that this guarantee reflects our dedication to delivering quality education.

Get The Course For $200 Discount. Input Coupon Code below

⏭ payrolllaunchpad3456 ⏮

Mary is very professional. She is most intelligent, thorough, conscientious, articulate, and very considerate. Her professionalism includes knowledge of diverse business operations, finance, tax codes and accounting. She is most reliable and cordial and I could not recommend anyone higher.

– Chris B

Unable to make payments? Contact me right away: [email protected]